We FIND and SHRINK your debt.

Fix Your Debts Fast...

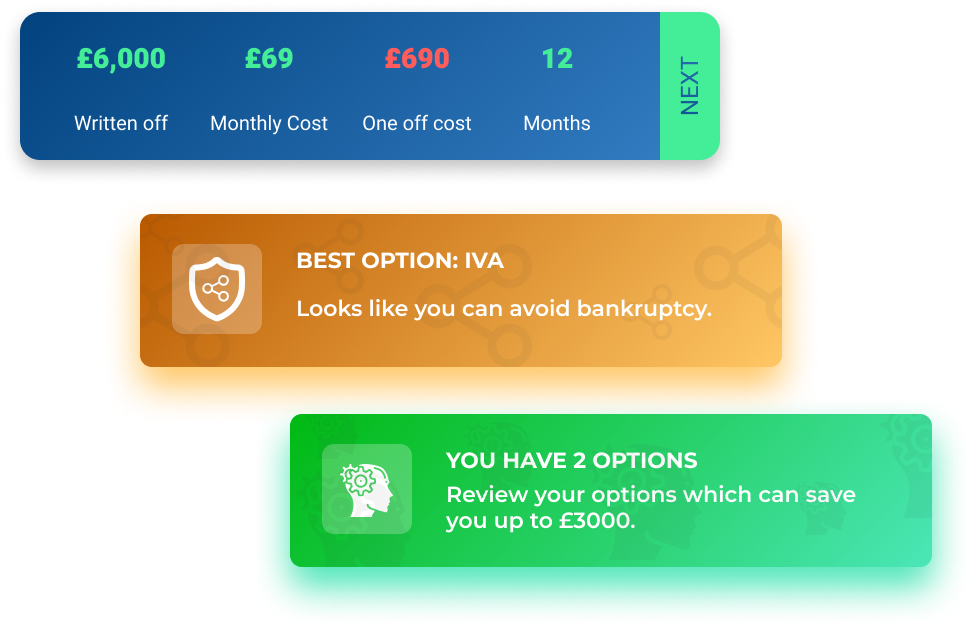

Discover how much an IVA could save you:

£40,000

£160

Monthly Payments

£11,520

New Total

71%

Written Off

DEBT SUPPORT

No matter what financial situation you are in, we are here to help. Our blogs and resources are a wealth of information to help you stay in great financial shape. We specialise in individual voluntary arrangements (IVAs), but always look for the best solution for your specific circumstances. With over 30,000 customers, you can trust us to provide the support that you need.

HOW IT WORKS

With highly personalised insights, our clever technology helps you get out of debt.

1We find your debts instantly

Sign up and we will ask you some simple questions to get your debts directly from your Equifax credit report. Soft Search Technology means your credit rating is unharmed.

2Discover your best debt options

We analyse your debts and display your best ways forward. You could write off up to 81% of whatever you owe.

3Speak to an expert

Debt specialists are on hand to help you navigate through your options. You then get to make an informed decision.

Credibble Crumbs Newsletter

Get smart tips on how to save money and reduce your debt.

Our promise

Valuable information

No nonsense, no jargon, no fluff: just straight talking.

Best solution

If we can save you money we will give you the best option for your unique circumstances.

No pressure

We will always help you to make an informed decision that is right for you.

Get. Debt.

Free.

Financial freedom made easy...

Frequently Asked Questions

What is Bankruptcy

If you are unable to pay your debts you can apply to make yourself bankrupt. Bankruptcy is a formal insolvency route and can have serious financial implications.

Bankruptcy is often seen as a last resort and, if appropriate to your circumstances, can be applied for when no alternative solution can be found – such as an Individual Voluntary Arrangement.

What is a Debt Management Plan

A Debt Management Plan is an informal repayment agreement between you and your creditors to pay all of your debts.

Debt management plans are an alternative debt solution to formal arrangements, such as an Individual Voluntary Arrangement or Bankruptcy and available to residents of England, Wales and Northern Ireland.

What is Debt Consolidation?

You apply to a lender for a loan to reorganise, or clear your debts. These loans are often advertised as ‘consolidation loans’. This means you swap some or all of your creditors for just one creditor.

If you own your home, the lender will probably want to take a charge on it. A charge on your home means that if you don’t repay the debt the creditor has a claim on the proceeds if the property is sold.

You should seek independent advice about whether this would be in your best interests. You should shop around for the best deal from high street and internet lenders. If you have a poor credit rating, you may not be able to get loans on the best terms.

What is a Debt Relief Order (DRO)?

Debt Relief Orders (DRO) is a formal debt solution designed for people with little or no assets and low income.

If you don’t own your own home & have little spare income and debts that are less than £30,000 a Debt Relief Order (DRO) could be a way to deal with your debts. It is an alternative debt solution to Bankruptcy or an Individual Voluntary Arrangement and available to residents of England, Wales and Northern Ireland.

What is an Administration Order?

An Administration Order is a way to deal with debt if you have a County Court Judgment (CCJ) or High Court Judgment against you and you cannot pay in full. The debt must be less than £5,000 and you make one payment a month to your local court. The court will divide this money between your creditors.

To be eligible for an Administration Order you need to:

What is a Negotiated Agreement With Creditors?

You contact your creditors and negotiate an agreement to repay all or some of the debts. Negotiated agreements may involve either or both of these:

Your creditors may be prepared, at the start or later, to agree to write off part of what you owe them. If they do so, they should confirm this agreement in writing.

Payments from income

You need to work out how much you can afford to repay, after allowing for your essential household and personal spending such as mortgage or rent, heating, utilities, and housekeeping. You should offer to share any extra income among all your creditors, based on the amounts you owe them.

This means that all your creditors are offered their share of what you can afford. You should also ask your creditors to freeze any interest or charges. Your creditors will expect you to give them regular updates of your income and expenditure so that they can see whether you can increase your payments.

Payments from lump sums

You may make payments towards your debts from a lump sum you receive and which your creditors may agree to accept in settlement of what you owe – that is, they agree to write off the balance they are owed.

However, if you do have extra income after paying your everyday expenses, they may expect you to make at least some payments from that as well.

If you can’t make payments temporarily, for example because of a short-term illness, creditors may agree to accept no payments or token payments of say £1 a month, but only for a limited period.

We can help reduce your debt

Official partner

for credit report data

Backed by

the Natwest Accelerator

Authorised

by The FCA